Life is full of surprises, and not all of them are pleasant. One moment everything is fine, and the next, your car breaks down, a pipe bursts in your home, or you’re facing an unexpected medical bill. A recent study found that a majority of people would struggle to cover a surprise $1,000 expense. This illustrates why having a reliable financial backup plan is so important. When you need money fast, a Cashup Loan: Flexible Financing Solutions for Your Life can be the lifeline you need.

This guide will demystify the world of quick, flexible loans. We’ll explore what a Cashup loan is, how it works, and how it can provide immediate relief without the long waits and complex paperwork of traditional lending. Along the way, you’ll find links to trusted resources like Forbes Advisor: How Personal Loans Work and LiveMint’s guide to personal loans for deeper reading. We’re here to give you clear, simple information, so you can make a smart, confident decision about your finances when it matters most.

What Exactly Is a Cashup Loan?

Think of a Cashup loan as a modern, streamlined personal loan designed for speed and convenience. It’s a type of unsecured loan, meaning you don’t need to put up collateral like your car or house. Instead, lenders focus on your ability to repay the loan based on your income and financial standing. It’s a financial tool built to bridge the gap when you face an emergency loan situation or a temporary cash-flow shortage.

The core purpose of a Cashup loan is to provide fast access to funds for a variety of personal needs. Unlike payday loans, which are typically very short-term and come with extremely high fees, a Cashup loan often offers more structured and flexible repayment options, making it a more manageable form of borrowing. For a deeper dive into the mechanics, Forbes offers a great explanation of How Personal Loans Work and you might also find the LiveMint explainer on personal loans helpful.

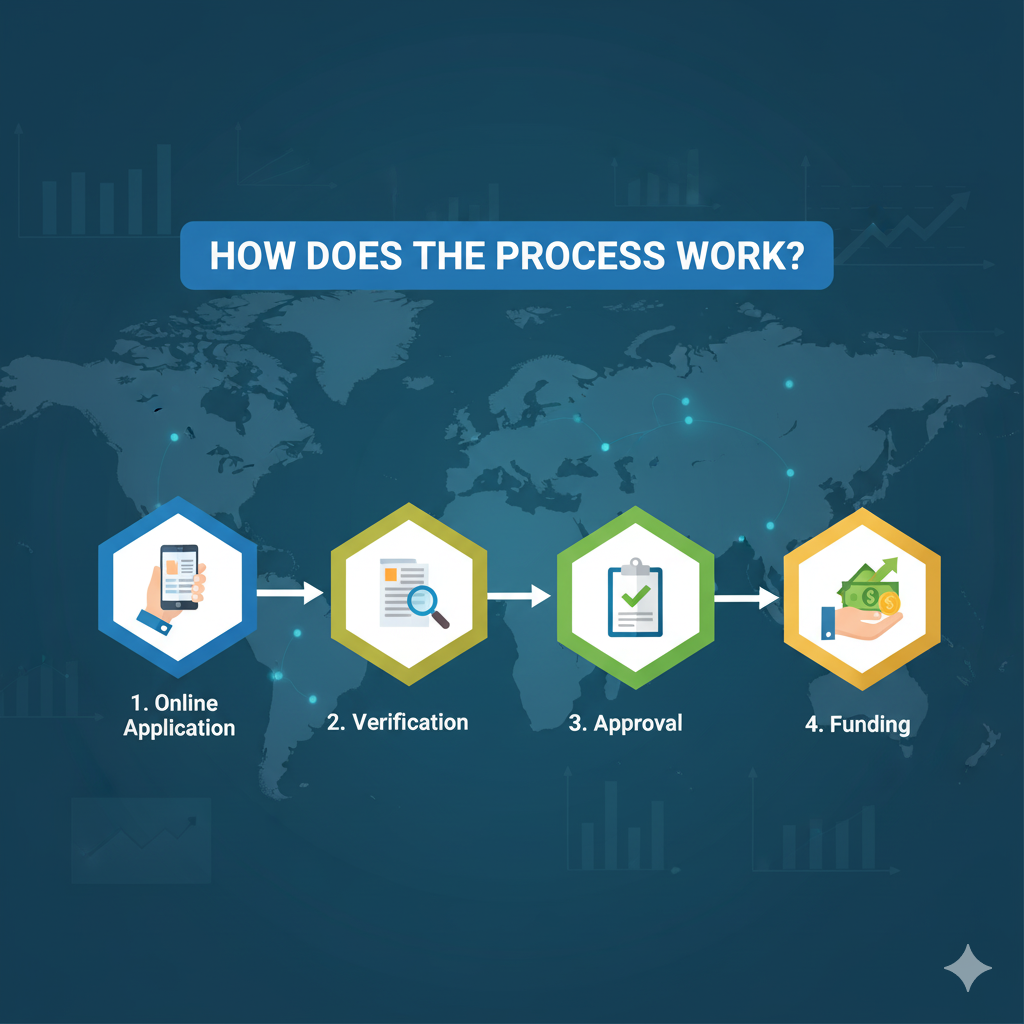

How Does the Process Work?

The beauty of a Cashup loan lies in its simplicity. The entire process is usually handled online or through a mobile app, making it incredibly convenient. Here’s a typical step-by-step breakdown:

- Simple Online Application: You fill out a short digital form with basic personal, employment, and income information.

- Instant Verification: Lenders use automated systems to quickly verify your identity and financial details.

- Quick Loan Approval: You often receive a decision within minutes.

- Fast Funding: Once approved, the funds are typically deposited directly into your bank account, sometimes as early as the same business day.

This streamlined process is what makes it a go-to solution for people who need money without delay. If you want to compare approval speed, The Economic Times highlights important features to consider before getting a loan.

Key Features That Make Cashup Loans Stand Out

A Cashup Loan: Flexible Financing Solutions for Your Life is defined by a few key characteristics that cater to the needs of modern borrowers. Understanding these features will help you see why it might be the right choice for your situation.

1. Flexible Repayment Terms

One of the biggest advantages is the flexibility in repayment. Unlike rigid loan structures, many Cashup loans offer options that can be tailored to your budget. This might include:

- Fixed Installment Plans: Predictable monthly payments over a set term, making it easy to budget.

- Interest-Only Payments: An initial period where you only pay the interest, which can lower your payments temporarily.

- Payment Deferrals: Some lenders may allow you to pause a payment for a month or two if you run into a short-term issue, although interest may still accrue.

If you want to better understand repayment structures and what to look for, Forbes breaks down how personal loans work, and you can compare features using The Economic Times’ factor list.

2. A Focus on Quick Loan Approval

When you’re facing an emergency, time is of the essence. The quick loan approval process is a cornerstone of the Cashup loan experience. By leveraging technology, lenders can assess your application and provide a decision much faster than traditional banks. This speed means you can address your financial need promptly, preventing a small problem from turning into a big one.

3. Accessibility for Various Credit Profiles

While a great credit score always opens more doors, Cashup loans are often accessible to individuals with a wider range of credit histories. Lenders look at a holistic picture of your financial health, including your income and employment stability. This broadens the personal loan eligibility, giving more people the opportunity to secure funding. Of course, your credit score will still influence the interest rate you’re offered, so it’s always wise to know where you stand. There’s an excellent article on How Lenders Decide Personal Loan Eligibility by Paisabazaar for a detailed breakdown.

Cashup Loan: Flexible Financing Solutions for Your Life is designed to help people access quick funds without stress. Whether you need money for emergencies, education, or debt consolidation, a cashup loan gives you flexibility with repayment terms and lower hassle compared to traditional bank loans. With careful planning, it becomes a tool to manage short-term needs while keeping long-term financial health intact.

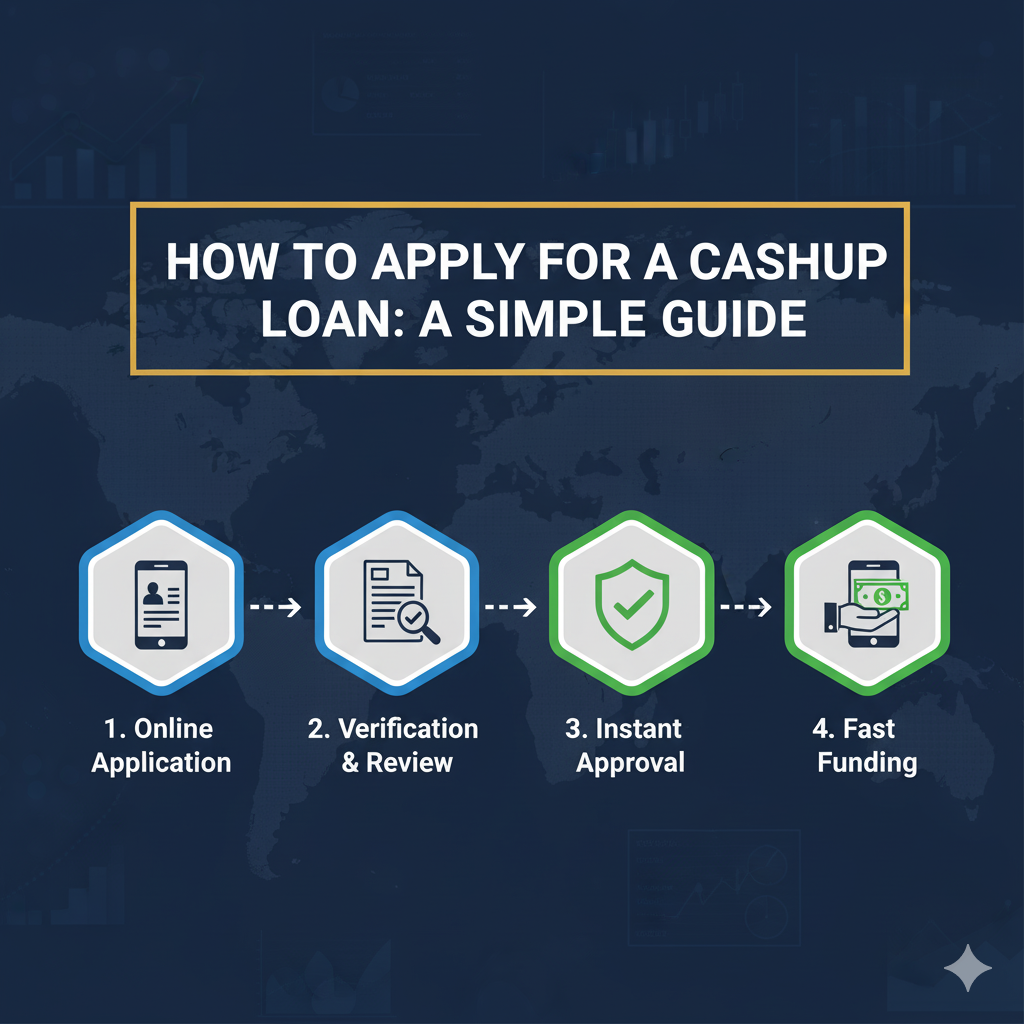

How to Apply for a Cashup Loan: A Simple Guide

Applying for a Cashup loan is designed to be a hassle-free experience. By following a few simple steps and having your documents ready, you can navigate the process quickly and efficiently.

Step 1: Complete the Simple Online Application

The journey begins on the lender’s website or mobile app. You’ll be asked to fill out a straightforward form that typically requests:

- Personal information (name, address, date of birth)

- Contact details (phone number, email address)

- Employment and income information

- Bank account details for the fund deposit

The application is usually designed to be completed in just a few minutes.

Step 2: Gather Your Required Documents

To ensure a smooth and fast approval, have the following documents ready to upload or verify electronically:

- A valid government-issued photo ID (like a driver’s license or passport)

- Proof of income (recent pay stubs, bank statements showing direct deposits, or tax returns if you’re self-employed)

- Your Social Security number

- Proof of a valid, active bank account

Having these items on hand will prevent delays and help the lender process your application right away.

Step 3: Review Your Offer and Receive Your Funds

After you submit your application, you’ll usually receive a decision very quickly. If approved, you’ll be presented with a loan offer that details the loan amount, interest rate (APR), and repayment terms. Review this offer carefully. If you accept, the funds will be transferred directly to your bank account, often within 24 hours.

Understanding the Fine Print: Loan Terms and Conditions

Before you accept any loan offer, it’s crucial to understand all the terms and conditions. This knowledge empowers you to borrow responsibly and avoid any surprises down the road.

Interest Rates (APR)

The Annual Percentage Rate (APR) is the total cost of borrowing money, expressed as a yearly rate. It includes the interest rate plus any fees. Always compare the APRs of different loan offers to find the most affordable option. Rates can be fixed or variable. A fixed rate stays the same, while a variable rate can change over time. Check out Forbes Advisor’s advice for guidance on understanding APR and total borrowing cost.

Loan Amounts and Limits

Cashup loans are typically for smaller amounts, often ranging from a few hundred to a few thousand dollars. The amount you can borrow will depend on your income, credit history, and the lender’s policies. It’s important to only borrow what you truly need and can comfortably repay. Using online financial calculators can help you estimate payments and see what fits your budget.

Potential Fees and Charges

Beyond the interest, be aware of other potential costs:

- Origination Fees: A one-time fee for processing the loan, often deducted from the loan amount you receive.

- Late Payment Fees: A penalty charged if you miss a payment due date.

- Prepayment Penalties: Some lenders charge a fee if you pay off your loan early, although this is becoming less common. Reputable lenders typically do not have these.

Always read the loan agreement thoroughly to understand the full cost of borrowing. The Economic Times’ feature breakdown will help you know what to expect.

Comparing Cashup Loans to Other Financial Options

A Cashup loan is a great tool, but it’s one of many available. It’s important to compare it to other options to ensure you’re making the best choice for your specific situation.

Cashup Loans vs. Traditional Personal Loans

Traditional personal loans from banks or credit unions are often for larger amounts and may come with lower interest rates, especially for borrowers with excellent credit. However, the application process is typically longer and more rigorous.

- Choose a Cashup Loan if: You need a smaller amount of money very quickly and value convenience.

- Choose a Traditional Personal Loan if: You need a larger amount, have good credit, and are not in an immediate rush.

For more about the differences, read this Forbes overview on personal loans or deep-dive into LiveMint’s detailed explainer.

Cashup Loans vs. Credit Cards

Credit cards offer a revolving line of credit that you can use as needed. They are great for everyday purchases and can be used for emergencies. However, taking a cash advance from a credit card often comes with high fees and a high APR that starts accruing immediately.

- Choose a Cashup Loan if: You need a lump sum of cash and want a structured repayment plan.

- Choose a Credit Card if: You need flexibility for ongoing, smaller purchases and can pay the balance off quickly.

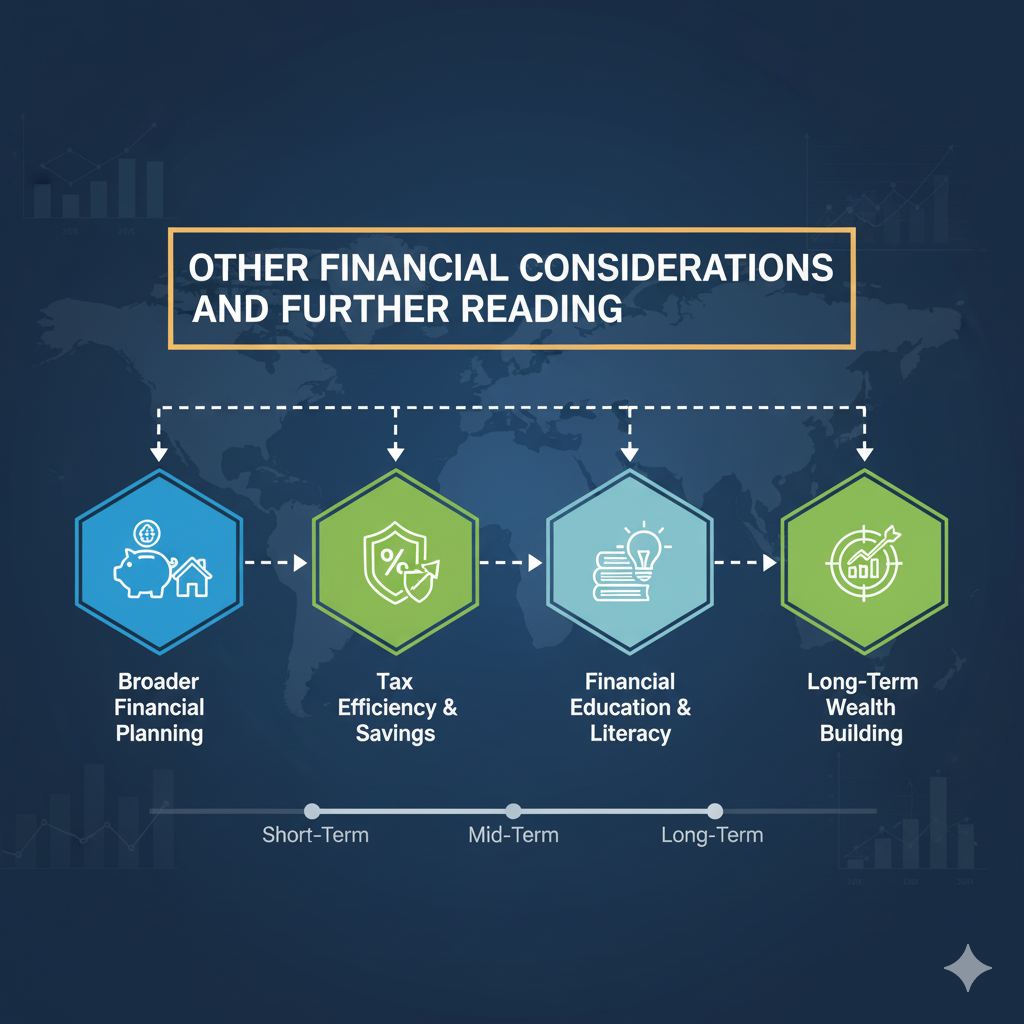

Other Financial Considerations and Further Reading

Since a Cashup Loan isn’t the only way to plan for emergencies and manage expenses, it’s wise to understand broader strategies for responsible borrowing and saving. For example, Investopedia provides a beginner’s guide to tax-efficient investing and the basics about tax-free financial concepts, which can influence your overall long-term financial strategy.

If you’re thinking of retirement, Forbes shares 6 Ways To Get More Tax-Free Income In Retirement, and those considering stable investment alternatives may want to check Vanguard’s guide on how government bonds are taxed or municipal bonds and their tax-exempt features.

If you want advanced strategies, Forbes features tax-efficient wealth strategies for high-income investors and investment tax saving moves before 2025. Understanding these approaches can help you use your loan funds wisely as part of a bigger wealth-building and protection plan.

Conclusion: Take Control of Your Finances with Confidence

When unexpected expenses arise, having access to a Cashup Loan: Flexible Financing Solutions for Your Life can provide the peace of mind and financial stability you need. With their quick loan approval, flexible repayment options, and accessible personal loan eligibility, these loans are built to help you navigate life’s challenges without unnecessary stress.

The key to using any loan wisely is to be an informed borrower. Take the time to understand the terms, compare your options, and borrow only what you need. By doing so, you can turn a financial challenge into a manageable situation. Ready to explore your options? Start by researching reputable lenders and using loan & credit tools to assess your financial health. For the latest financial insights, continue to educate yourself and take charge of your financial well-being.

Frequently Asked Questions (FAQ)

1. Who is eligible to apply for a Cashup loan?

Generally, you must be at least 18 years old, a U.S. resident, have a steady source of income, and have an active bank account. While eligibility criteria vary by lender, many are open to applicants with a range of credit scores. For specifics, review Paisabazaar’s guide on personal loan eligibility.

2. What can I use a Cashup loan for?

You can use the funds for almost any personal expense. Common uses include covering emergency medical bills, urgent car repairs, unexpected travel, or bridging a gap between paychecks. They are best suited for short-term needs, much like the scenarios highlighted in LiveMint’s guide to personal loans.

3. How fast can I get the money?

The process is very fast. Many applicants receive an approval decision within minutes, and funds are often deposited into your bank account within one business day, with some lenders even offering same-day funding.

4. How is a Cashup loan different from a payday loan?

While both offer fast cash, Cashup loans typically provide more structured and flexible repayment terms, similar to a traditional personal loan. Payday loans are very short-term (usually due on your next payday) and are known for having extremely high fees and interest rates. Forbes Advisor covers the important distinctions and benefits of traditional personal loans versus alternatives.

5. Will applying for a Cashup loan affect my credit score?

Most lenders perform a soft credit check during the initial application or prequalification stage, which does not affect your credit score. If you proceed with a full application and accept a loan offer, the lender will likely conduct a hard credit inquiry, which can cause a small, temporary dip in your score.

6. How much can I borrow?

Loan amounts can vary widely depending on the lender and your individual qualifications. They typically range from a few hundred dollars to several thousand dollars, designed to cover immediate, short-term expenses.

7. What should I look for in a loan agreement?

Always look for the Annual Percentage Rate (APR), which represents the total cost of the loan. Also, check for any origination fees, late fees, or prepayment penalties. Make sure you fully understand the repayment schedule and the total amount you will pay back over the life of the loan. For a thorough checklist, see The Economic Times’ guide.